Last week we talked about the risk aversion beneath the surface and how it differed in comparison to last year's excellent January returns for stocks. And of course we have talked at length for awhile now about the significance of the resistance in the Dow that was reached. Well this holiday shortened week continued that theme as the major averages all suffered loses of around 2% on Friday. And this comes after a triple digit loss in the Dow the previous day as well.

After Friday's drop the major averages have now exceeded the size of their previous correction, a major warning sign of potential trend change. In the S+P 500 as depicted in the chart above, the biggest correction in 2013 was a drop of 126 points. This projects support around September's high in the 1730 area with the 200 day moving average coming in as support at 1701 as of right now. Investors will not want to see the S+P 500 spend much time below.

As for short term support, traders will likely need to defend the last swing low at 1768.

The Dow has a little more consistent pattern, as each of the three corrections during 2013 produced drops of 900 - 1000 points. That projects support at the May and July highs coupled with the 200 day moving average below. As with the S+P 500, investors do not want to see price get below that zone.

As for the market internals, the S+P 500 advance - decline line closed below it's 50 day moving average. The NYSE advance - decline line continues it's bullish trend.

To reemphasize the risk averse theme the Volatility Index (VIX) spiked 30% on Friday. It's still below the 20 level, a level it topped out at a few times last year. Anything above 20 signals caution, anything over 40 would be more of a warning.

The last cyclical sector that still meets my criteria of being in a bullish trend (more on that in the conclusion) would be Technology (XLK). $35 becomes the next key area to watch with $34.50 as the line in the sand.

The risk aversion was confirmed in the credit markets as well, as the long term treasuries were the biggest beneficiary. This chart above just basically shows the investor demand for the safety of treasuries (risk off) to the demand for lower quality, higher yield bonds (risk on). This trend has turned from bullish to neutral.

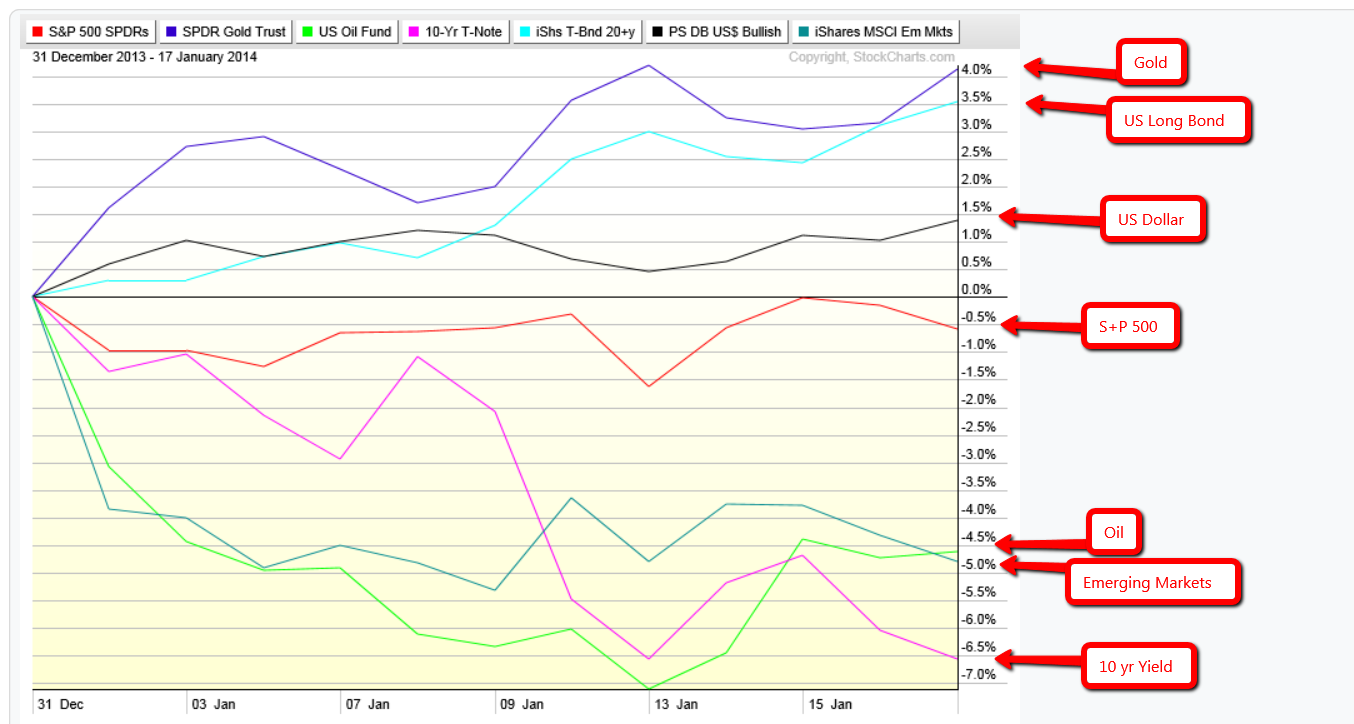

The year to date performance by asset class continues to show risk aversion and flight to quality. Although this is still a small sample size it does represent a shift from the previous. At this time last year the S+P 500 was up 5% ytd 2013.

In conclusion I am introducing a new concept. It is a trend defining tool that takes into account the four major averages, ten sectors, VIX, credit market indicator and 2 market internal indicators. This is not a market timing tool, as it will not spot major turns in the market, that is what the technical analysis will be for, rather it will define the trend at hand and the strength there of. This week a bunch of the trends turned from Bullish to Neutral, with Technology being the only cyclical sector remaining in a short term uptrend.