We had a typical rotation day in the markets with average volume and daily range. It was another uneventful day to say the least, and mirrored yesterday's price action rather well.

We gaped up but still opened in yesterday's value area, I really thought we would see a gap fill early on, but bulls defended yesterday's midpoint and off we went. Again notice the 23% range extension once again calls the high of the day to the tick!!!! Made for a great short entry, and turned out to be really the best/only decent trade of the day.

Just like yesterday, market rotates up to build volume value, eventually finds some sellers and rotates right back to its starting point. Again typical rotation day action, however these small daily ranges are quite frustrating. It would be nice to see the VIX back over 20 again, maybe we could get at least 20point S+P ranges once again.

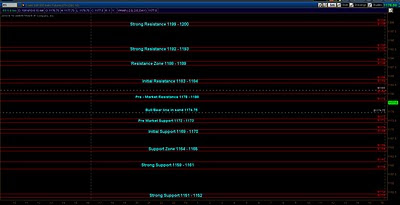

My Bull/Bear line will once again be 1113, as long as price stays above that level, a test of 1129 is imminent, then 1149 before any correction may take place, on its way to 1230's. We did however close below the midpoint again for the second straight day. So we may very well be setting up for some weakness for the rest of the week, under 1113 expect to see some long liquidation as well.

We have unemployment claims tomorrow @ 8:30 AM, and Friday is Non Farm Payroll and Unemployment Rate, which is historically the most volatile day in the markets. Expect to see some range expansion either way for the rest of the week.

A couple of things I want to say on the lack of volume on this run up, one is to look at where market is accepting value, in other words don't focus on the total volume but focus on what price levels the volume is coming in at. Which is why I always display the volume profile charts for the day in my reviews. As long as the market accepts value higher, that is bullish, doesn't necessarily matter what the total number for the day is.

I believe the lack of volume is bullish, for it shows a lack of participation by longer time frame sellers. One of the many reasons I have explained for some time now, as to why I see higher prices in the near future. Longer term bears (ones with the real money to move markets) are waiting for higher prices, is my interpretation of this price action.

Again I am fully expecting to see 1230's trade by summer time, the only thing that would sway me would be acceptance of prices below 1050's.

Lastly, I have shown many the advance - decline chart of the NYSE, that shows extreme bullish levels, even surpassing those of the 2003 bull market and how it has bounced off its 20sma even before the correction last month ended. I gave two levels using recent price action that I believed the correction of the market would end, while the market was still selling off.

I said 1080 - 1068 would match the corrections we had last fall percentage wise, well we bounced off that level initially for some nice profits, but failed to hold.

The next zone I mentioned was 1045 - 1030, which would match the correction last June/July percentage wise. I said I couldn't get bearish until I see those levels taken out, because it would have broken the rhythm of the market all the way up from the March lows.

Well we hit 1040's and bounced, breaking short setups all the way up, in light of all the bearish sentiment out there, and if I am reading the tape correctly, we will see new highs in the not too distant future.

I say all of this not as a pat on the back for myself, believe me I am no guru. But too enlighten us traders to study PRICE ACTION and VOLUME only! I can not stress this enough, I made such progress as a trader when I learned this.

There is a rhythm to every market, it's up to us to figure it out. Let CNBC talk doom and gloom and end of the world scenarios, price action has been screaming bullishness since March. The bears will certainly have their way once again at some point, although I don't believe it will be anytime soon. Regardless when they do regain control there will be a rhythm to that market as well for us to follow.

My .02

Support and Resistance levels worked well today, our bull/bear line in the sand worked very well.

Support and Resistance levels worked well today, our bull/bear line in the sand worked very well.

.bmp)