thetechnicalinvestor.wordpress.com

Those who follow by email can continue to do so by clicking the follow button in the bottom right screen on the new site and enter email address.

Thanks

Mike

Staying ahead on the right side of the markets with cutting edge technical analysis and forecasting methods.

Sunday, April 13, 2014

Saturday, April 5, 2014

Market Summary: Outside reversal day as Dow gets rejected at Long term resistance once again...

We pointed out this interesting long term pattern in the Dow last year. This week, for the second time, we tested those resistance levels. On Friday, after hitting resistance the Dow (and all other major averages) put in an outside reversal day lower, closing at lows.

This daily chart of the Dow notates this second rejection. I continue to maintain this cautious approach as risk vs reward may or may not be ideal at these price levels. And as we took a look at, continued weakness abroad many of the growth and momentum names. However as we will see in this post, when we take a look at the big picture we still see a bull trend in tact. So although cautious, I don't see any reason for panic.

Looking at the S+P 500 daily chart above, we see the tough day that Friday was. However even with Friday's action, the S+P still put in a positive close on the week and trades positive year to date, still above it's 50 and 200 day moving average.

One index that I don't hear much talk about is the S+P 100. This index holds 100 of the largest stocks by market cap. It's very close to it's 2007 highs now, a potential added confluence for resistance, at least on first touch.

The Nasdaq is under more selling pressure as it's 5.58% below it's highs and negative year to date.

We can see the difference as the percentage of stocks on the New York Stock Exchange trading above their 150 day moving average is 72% (a healthy number).

Whereas the percentage of stocks on the Nasdaq trading above their 150 day moving averages is 55%, still a good number, anything above 50% is pretty healthy.

It was interesting to note that with Friday's ugly day the Volatility index was only up about 4%. It's really hard to get overly bearish with a VIX reading sub 20.

The cumulative advance - decline lines for both the S+P 500 and the New York Stock Exchange continue in solid up trends.

The spread between high yield and treasury bonds have even firmed up a bit, holding it's 200 day moving average.

Sector performance year to date continues to favor Utilities and Health Care.

Performance by asset class year to date.

Lastly the trend matrix continues it's moderately bullish theme, there were no changes from last week. This is not a market timing tool, but rather a gauge of the direction of the overall trend and the strength thereof. The stocks in the S+P 500 trading 20% or greater below it's 52 week high has ticked down to 6.8%, down from 7.0% last week.

So there you have it, we do have some resistance levels above to keep an eye on. However the underlying trend and internals continues to be supportive.

Amazon (AMZN) Tesla (TSLA) and Biotech (IBB)...

Many growth and momentum names have experienced a considerable amount of selling pressure recently. I've decided to take a look at a few. Amazon (AMZN) chart above shows the bull market run off it's 2008 low. It's now matched the size of it's biggest correction at $80 points and now stands at some short term support levels.

Note the percentage move of that previous correction was approximately 32%, as of Friday's close Amazon is 20% off it's highs.

Amazon came into short term support on Friday, matching the size of the previous decline off it's all time high (70 points) and near a previous swing high at $313. As you can see it now trades below it's 200 day moving average, which is always a caution sign, resistance now stands around $350. Which trend will give way?

We've done a pretty good job analyzing Tesla. We defined support in advance here and came up with a $270 price target here. The swing high came in at $265 and it has since traded back down to it's 50 day moving average. Support now stands around $195 which is the previous swing high and $185 which would match (in points) the previous drop from $195.

Biotech has been a monster this entire bull market, the chart above is the Nasdaq Biotech etf by iShares, one of it not the most popular etf tracking the sector. Since 2009 it's had two 25% drops and two 13-14% drops, on it's way up some 400%.

Now this most recent drop has come on increasing volume, which is worth noting. As of Friday's close the sector is down around 18% from it's highs and nearing it's 200 day moving average. The way I see it, support at $212 and $202 will be critical for the near term direction of this trend. These levels of course come in as support as previous swing highs but would also match the size (in percentage points) of the biggest drops biotech has experienced since the 2009 bull market began.

It will be interesting to see how this all plays out. I'm always cautious of any market that breaks the rhythm of it's long term trend.

Saturday, March 29, 2014

Market Summary: This is not 2013...

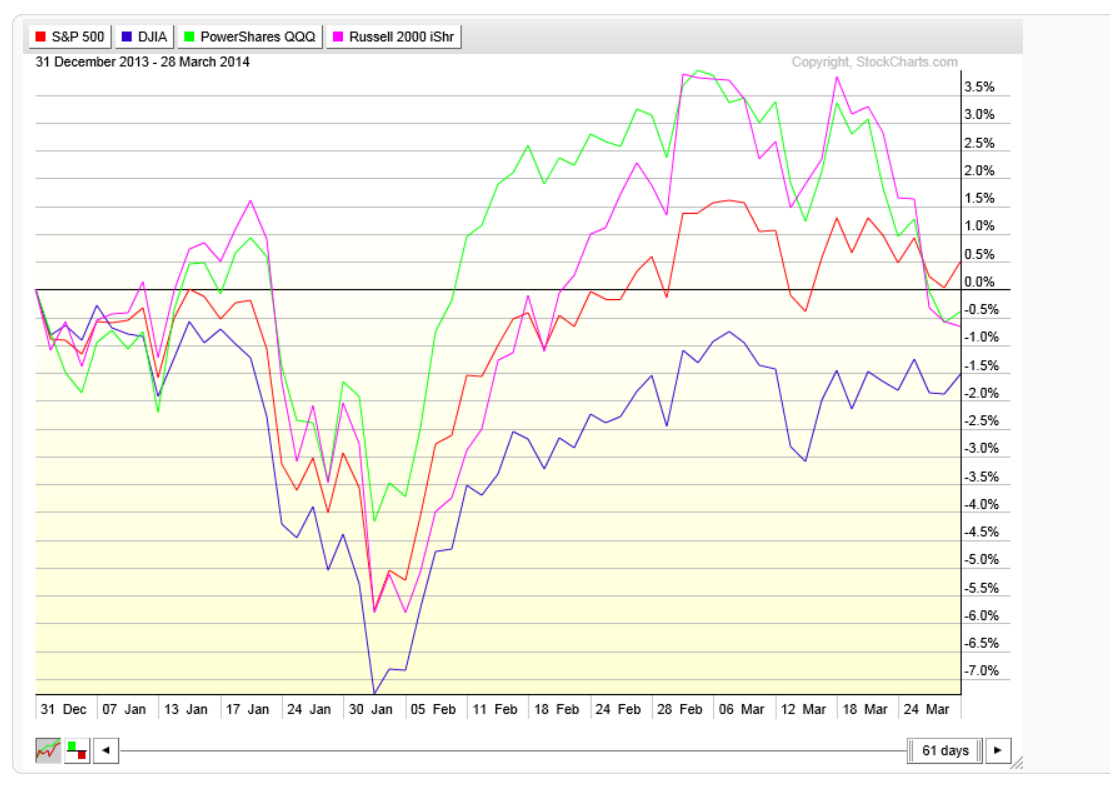

So far in 2014, market returns on the equity side of the allocation have been hard to come by. After 61 trading days for the year 2014, only the S+P 500 is showing a slight gain (below 1%). The Dow, Nasdaq and Russell 2000 (small caps) are all in negative territory year to date, although not by much.

Let's rewind to year 2013 and we see that the first 61 days last year proved to be much better for equities. At this point last year, three out of the four major averages were sporting double digit returns already.

In January of this year the S+P 500 matched it's biggest correction of 2013 before rebounding and making another all time high. The market is currently stuck between a range defined by 1840-1880 swing high/low pivots. However even with all the recent volatility the S+P 500 remains only 1.5% off it's all time highs.

This 60 minute chart above shows this recent trading a little more closely. A break below 1840 sets up the expectations for a drop to at least 1809-1799, the zone that is marked on this chart above. Of course a break above would likely setup the expectations for a rally to new highs to 1940 or so.

The Dow Jones average has been in negative territory all year after hitting long term resistance projected in the pattern we defined going back to last year. The Dow started off the year by matching and slightly exceeding it's biggest correction size of 2013 before rebounding. Unlike the S+P 500 it failed to make new highs on the rally and now sits inside a similar trading range to the S+P 500.

The Nasdaq also matched its biggest correction of 2013 during the January drop. However more recently we have seen more weakness in the small caps and the tech heavy NASDAQ. While the S+P and Dow continue it's trading ranges the Nasdaq and Russell have actually broken down a bit. The Nasdaq is 5.5% off it's highs as of Friday's close.

The Russell 2000 is also 5% off it's highs and has made a recent lower low as it dips below it's 50 day moving average. The Nasdaq and Russell still remain in bullish up trends however this weakness is worth noting as it signals a possible reduction is risk taking.

The market internals still look strong as both the New York Stock Exchange and the S+P 500 advance - decline lines remain in solid positive territory year to date.

New 52 week highs on the New York Stock Exchange are in short term oversold territory as the bearish divergence continues.

Another bearish divergence can be found when looking at the spread between high yield bonds to treasury bonds. A higher reading means investors are more willing to buy higher yielding (riskier) bonds in place of (safer) treasury bonds.

Sector performance year to date shows Utilities taking the clear number one spot, showing returns of 9%. Health care has been under pressure of late due to the recent volatility in Biotech, which now makes up almost 20% of the sector. Cyclicals, 2013's best performing sector, comes in as the biggest under performer as of Friday's close.

Asset performance year to date continues to show relative strength in Treasury's and Gold, while emerging markets is starting to show some life but still comes in as the laggard year to date so far.

The trend matrix continues in it's bullish theme, although slightly less bullish than it was two weeks ago. As the Nasdaq 100 (QQQ) small caps (IWM) and Consumer Discretionary (XLY) sector turn from a Bullish to Neutral trend reading. This is not a market timing tool but rather a gauge of the direction of the dominant trend and the strength thereof.

Another indicator I follow is how many stocks in the S+P 500 are in bear market territory. I use stocks trading below 20% from it's 52 week high as my criteria. Last week the reading came in as 6% of S+P 500 stocks in bear market territory. As of Friday's close that number has now gone up to 7%. Still far from danger territory but worth watching nonetheless.

In conclusion, I am still concerned with the potential downside risks in equities over the short term. However with all four of the major averages in up trends above their 50 and 200 day moving averages and the market internal readings as strong as ever, there is absolutely no reason to jump the gun and start crying market top. Investors expecting 2013 type returns from equities may very well be dissapointed, but that doesn't mean we can't get a 10-15% return in equities by year's end. All it proves is the importance of diversification among asset classes. Those investors that chose to re-balance their portfolios by rotating some of their stock earnings into their bond allocation have been rewarded.

Friday, March 28, 2014

Twitter (TWTR) price chart update ...

There is a saying that goes "the market tends to do the expected, but in unexpected ways". I bring this up in regards to twitter stock because all I heard going into it's IPO was how everyone wanted to be a buyer around the mid to low $30 level.

The daily price chart above goes all the way back to Twitter's IPO last year. In my last comment I made on this particular stock I mentioned how the stock price had fallen back to it's IPO high (horizontal white line) and how it needed to hold that level if it had any chance of continuing higher. We did get a short term bounce off that level but the selling pressure has remained for fundamental reasons, as it's first quarterly earnings report left a lot to be desired.

Twitter has now dropped 42% off it's highs and is down 27% year to date. A full 50% retracement from highs drops the stock price back to it's lows at $38. Investors may very well get their low to mid $30's price point that they clamored for during it's IPO, after all.

However this is not unusual for growth stocks in their infant stages, and doesn't necessarily mean that Twitter is a broken stock with no future. Let's take a look at a couple recent and very popular names. Facebook (FB), chart above, dropped 61% off it's IPO high price, albeit for different reasons.

The stock eventually found support, fundamental factors kicked in to support the stock price and it has rallied higher over 313% in the last 18 months since.

Tesla (TSLA) experienced drops of 50% during the first week of it's IPO and 42% a few months later.

It's now some 1200% off those lows over the last 3 and a half years.

Of course there are plenty of other examples out there. The purpose here is not to compare twitter to any of these others. I certainly have no idea whether twitter will take off in similar fashions or not. I am not long any of these names but would seriously consider twitter in the low to mid $30 range if it did happen to get there.

The purpose here is to show that although these names are popular and have a lot of hype surrounding, they are awfully volatile and should be treated as such. If you can stomach these 50-60% corrections in a short amount of time then they may have a place in your portfolio. Otherwise don't get sucked into all the hype and emotions.

Wednesday, March 19, 2014

Market Update: Post FOMC observations...

The stock market saw a bit of a sell off today as the FOMC statement and press conference took place. The entire statement can be read here but basically the Federal Reserve continues to stay the course of tapering it's bond buying program by another $10 billion a month but drops it's 6.5% unemployment rate threshold.

The S+P 500 chart above depicts how each of the three tapering statements has been digested. The initial announcement in December of 2013 saw the markets move substantially higher. The second announcement was not greeted as well as it kicked off a 60 point drop in the S+P.

Today's announcement traded more like the last. So I think if the market spends much time below it's year to date break even point (yellow horizontal line) a similar drop taking the S+P to 1815 and 1770 is quite possible.

Gold, still outperforming by a clear margin, has seen some recent short term selling pressure as it nears a key pivot high at $1434. Today's drop marks the biggest correct seen in Gold year to date. Near term support comes in roughly at $1330 but expect some short term volatility around this level as there remains a lot of "congestion" left behind in a cluster of swing highs and lows.

One pattern I see in Gold is the day after each taper announcement has taken place, Gold has ended in the red. This is quite a small sample size to get any real edge one way or the other. The next potential downside pivot I see is the low at $1308. This would be almost exactly two times the size of the last short term correction (a common occurrence) and the midpoint of the entire run up from it's low at $1180.

Interest rates spiked today as bond prices fell. The yield or interest rate on the 10 year treasury bonds rose over 3% today. An interesting observation is denoted in the chart above, the horizontal lines show the settlement price on the days QE 1 was announced. This most recent trading range has engulfed those two prior pivots and it appears interest rates are higher now, then when they were when QE 1 was expanded by over $1 trillion of MBS and treasury debt/securities.

Lastly, taking a look the US dollar via the spot futures continuous contract. I've denoted the $84.50 level (grey horizontal line) which is the settlement price of March 18th, 2009 (QE 1). During the entire time where the Federal Reserve was significantly adding to it's balance sheet, the value of the USD fluctuated from positive 5.2% to negative 13.79%, according to the futures price chart. And the actual swing low came in 2008 before quantitative easing had begun.

Now it's quite obvious on the chart above that the USD had experienced significant devaluation leading into the financial crisis and Fed response. It's quite possible that the market began to price in what was to come, will in advance. Regardless the drop in the USD was 40% from the 2001 high to the 2008 low. And all without more than a brief 38% retrace rally during the financial crisis of 2008 where investors fled from risk assets and demanded USD and treasury bonds.

It's clear from a technical point of view that the USD is still well within a long term downtrend. For me it would take a break above the $90 level to begin to think otherwise. Until then a revisit of 2008 lows is quite possible.

Friday, March 14, 2014

Stock Market Summary: As the Bull Market turns 5 years old...

The S+P 500 is now 2.25% off it's all time highs as concerns over China growth, Russia, future monetary policy, among others, abound. Recent history has shown the S+P 500 put in a higher high on average of about 35 points above it's previous (as denoted on the chart above). This pattern seems to be continuing as Friday's close has completely wiped out all the gains that came about last week as at that time a possible diplomatic solution to the situation in Crimea seemed possible.

The situation in the Dow Jones Industrial Average appears even more short term bearish as the average closed below the low of it's previous week after retested the long term resistance area once again, an area we have pointed out beforehand numerous times. Perhaps signaling the beginning of a short term trend change.

We saw a sharp spike in volatility and put protection as the VIX found support on 3 separate occasions in the last month at the 13.50 level. It's quite possible we once again test the upper end of this range in the 20-21 area before it's finished.

One of the bright spots has been Health Care and Utilities. The Utilities sector price chart above shows how it's bucked the trend of the broader market by finding support early in the week and rallying to a new closing high.

The advance - decline lines of both the New York Stock Exchange and the S+P 500 index remain in strong up trends above their 50 and 200 day moving averages and prior swing highs.

The sector performance year to date continues to show investors risk appetite to be light as the majority of the gains come from the Utilities and Health Care sector, mainly considered "risk off" or more "risk averse" investments.

The year to date performance by asset class reinforces this "risk off" theme as Gold and Treasury Bonds come in as 2 of the top 3 performing asset classes so far in 2014. I've added Real Estate by using the exchange traded fund IYR. In fairness and keeping a balanced approach we must ask ourselves, is this recent performance just a "value play"? (as Gold and Bonds were two of the worst performers in 2013 and Utilities was the worst performing sector for 2013) Or the beginning of a larger risk averse theme that often times precedes a significant market correction?

The trend matrix this week continues it's bullish stance as 16 out of the 18 components remain bullish with 2 neutral. The best advice for most investors (especially new ones) is to follow the trend and to not get too caught up in all the noise surrounding you, put your blinders on so to speak. As an investor just try to focus on what you can control and quantify (which is current market data).

In conclusion, we have come to the fifth anniversary of the bull market that began in 2009. The last major bull market we had ended at it's 5th year but that by itself doesn't mean it is going to happen to this one as well.

I've highlighted the corrections we have experienced in these five years, to go along with the breakdown of the previous bull market I did last week. The first thing you should notice is that although this current bull market has surpassed the returns experienced in the 2002-2007 bull market, the volatility during has been much greater and harder to endure. During the 2002-2007 bull market we went over 4 years without a 10% correction. During this bull market we have already had 3 separate corrections of over 10%, including a 21% drop in 2011.

Like the saying goes "no pain, no gain". And while the doom and gloomers have continued to push their messages and agendas through every available medium, they have scared ordinary investors half to death. And while they wait for their 30%, 40% even 50% or more "crashes" in the stock market the S+P 500 has nearly tripled off it's 2009 low.

This next week will likely be a key week on both a technical and fundamental level. On Wednesday the new Federal Reserve chairman Janet Yellen will be holding her first press conference as Fed Chair, possibly giving more indications of future monetary policy and economic projections. And of course the events unfolding this weekend in Crimea may very well have at least a short term impact on the stock market as well.

Subscribe to:

Posts (Atom)