On Wednesday the Federal Open Market Committee (FOMC) in it's policy statement, made public it's decision to go ahead and begin the process of "tapering" it's QE 3 bond buying program at the sum of $10 billion a month. However also adding that:

"The Committee now anticipates, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate well past the time that the unemployment rate declines below 6-1/2 percent, especially if projected inflation continues to run below the Committee's 2 percent longer-run goal."

In layman's terms it basically means we should continue to expect a highly accommodating monetary policy for as far as the eye can see. For a full briefing I would recommend visiting this link which takes you directly to the latest FRB Press Release.

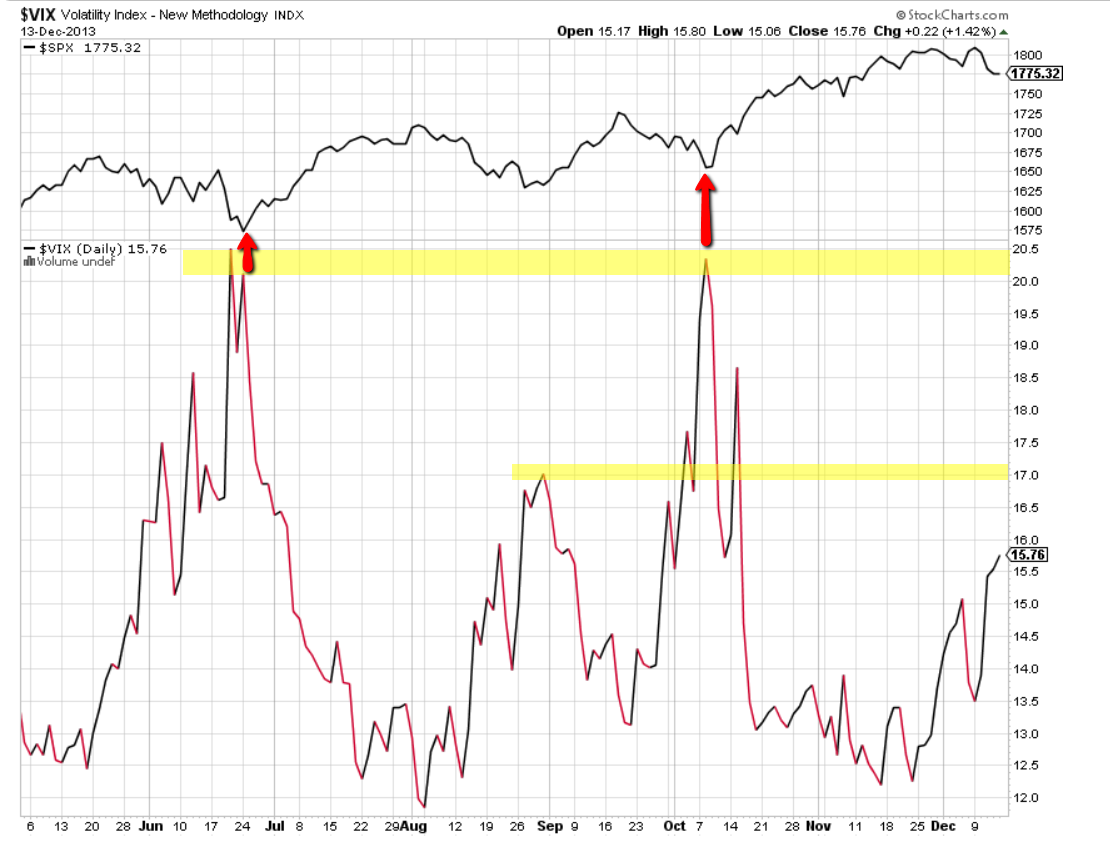

The markets took the news in stride and by Friday all four of the major averages made fresh new bull market highs. The S+P 500 chart above shows the trading range around support earlier in the week and the rally back up to the top of the short term trend channel.

The Dow also found support the previous week and actually stayed above last week's low the entire week before also taking off higher to new highs.

The Nasdaq 100 also made a new high on Friday after finding support during the volatility that Wednesday's FOMC statement brought.

The Russell 2000 (Small Caps) is my favorite chart of the week. I've highlighted the symmetry this index has shown over the last 6 months or so. Each correction has been almost exactly $5 points in length before finding support and making new highs. This is about as picture perfect as you can get in these markets .

A recap of the performance this week shows the Dow Jones actually coming in as the top performer with the Small caps not far behind. Emerging markets continue to struggle in part due to these changes in monetary policy.

The Advance - Decline line does continue to show an underwhelming divergence, however as I have highlighted, the last correction almost equaled that of the previous which occured during the debt debate and government shutdown. So although the bearish divergence persists there has been no follow through to break the upwards momentum thus far.

Taking a look at how the sectors performed relative to the S+P 500 for this week, we saw the strength come from the Industrial, Basic Materials, Health Care and Financial Sector. While the weakness was felt in the Utilities, Energy and Consumer Staples sectors the most.

Taking a look at Bond performance for the week, Long Term Treasuries (TLT) ended the week with over a 1% gain while on the other side the TIPS (Treasury Inflation Protected) bonds suffered a small loss.

And finally, credit markets showed a little bit of uneasiness this week. Something I will pay attention to going forward. All in all the market continues it's ascent higher and there's really nothing to get overly bearish about at the moment. However it's most important to manage risk and maintain disciple, the temptations for many will be to chase these rallies with every penny they have and all the risk they can find. The key is to find the balance of putting money to work with realistic expectations and within your time frame and investment objectives.