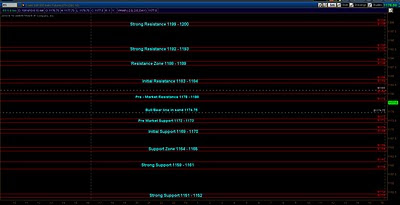

Support and Resistance levels worked well today, our bull/bear line in the sand worked very well.

Support and Resistance levels worked well today, our bull/bear line in the sand worked very well.We spent much time above the 1174.75 line in the sand in the overnight session, and was even able to hold that level after the dissapointing UE claims number. But shortly after 9am we broke through to the downside down to pre market support level for a small pause, but lack of buyers called for even lower prices, we then tested the initial support level where we got an improved bounce back into the 1174.75 line in the sand.

The market became bracketed between initial support and the bull/bear line in the sand making for some decent two way trading. However we broke to the downside shortly after the European close as the finincial sector weakness early on brought the broader market down with it.

We fell to the support zone and got another bounce in that area back up to the initial support level. What was support became resistance and the market made one more break to the downside to make one more/last lower low.

Now there was no real support at that level but if you take yesterdays day session range which was 12pts, you take that 12pt range and subtract it from the 1175.50 high you get 1163.50 which is very close to the 1162.50 which eventually became the low for the day.

The maket going into the close and in anticipation of the Google earnings release broke back inside the initial balance and rallied back to the high extreme area of the day showing more conviction by the bulls.

We have heavy acceptance in the 1168 area today, overnight and pre-market support and resistance levels will be 1177 - 1178.50 on the upside, 1168 - 1166 to the downside.

1180 - 1181 could be tested in the overnight session as Google as I type this is trading some $40-50 up already and the Nasdaq futures have made a new 2010 high already.

I am going to use my bull/bear line in the sand as 1181, bullish above and bearish below.